News

Achieving SDG7 in Africa through Interconnected Mini-Grids

How can grids in Africa and on other continents connect urban and remote areas, while providing enough energy for enterprises to flourish? Can this energy be clean, affordable and reliable, all at once? These questions were highlighted from different angles in a recent online discussion of the Africa LEDS Partnership and the LEDS GP Energy Working Group, supported by Berlin-based think tank SD Strategies.

Together with international partners, countries have already made significant progress towards achieving the Sustainable Development Goal (SDG) 7: universal access to affordable, reliable, and sustainable energy by 2030. However, it is often difficult for national utilities to serve remote customers.

“Mini-grids can help”, says Divyam Nagpal, Programme Officer at the International Renewable Energy Agency (IRENA). Mini-grids are an effective way of providing off-grid areas with energy. Worldwide, already 19,000 mini-grids have been installed, serving 47 million people. Looking ahead, most of the planned mini-grids are solar-hybrid systems in Africa.

What are IMGs?

Most mini-grids are designed to provide remote communities with energy. Oftentimes, however, also urban or peri-urban customers, served by large-scale power networks, face unreliable or unstable electricity access. This is where interconnected mini-grids (IMGs) come into play. The key advantage of IMGs is that they can provide reliable energy under existing larger grids. “IMGs are decentralized units that stabilize larger grids, that are able to support and extend them, and that can play a critical role toward achieving sustainable energy access for all”, says Alexander Ochs, CEO of SD Strategies and Chair of the LEDS GP Energy Working Group. Modern, integrated electrification planning “involves a dynamic interaction between different solutions rather than a static one”, Mr. Nagpal adds. “That’s where IMGs really fit in so beautifully”.

“When you interconnect to a mini-grid, you’re catching two birds with one stone”, as Riccardo Ridolfi, CEO and co-founder of Equatorial Power, puts it. First, they help stabilize the grid system and therefore reduce technical losses. Second, they serve as a community interface, reducing commercial losses. Through their local presence, they also create local jobs (electricians, customer care) and reduce operational expenditures.

Potential of IMGs in Africa

In many African countries, electrification solutions such as mini-grids and IMGs are much needed. Take Uganda, where 75% of population doesn’t have access to electricity. Even though, as Mr. Ridolfi argues, there are good regulations in place and the government has real plans. Also, Uganda has one of the rare profitable national utilities on the continent.

Or take Nigeria, where 80 million people are lacking access to grid electricity. Nigeria estimates its peak demand at 25,790 MW while the total installed capacity is only at 12,522 MW. However, what is actually distributed is much less. Of the 6.800 MW that are being generated, only 3,800 MW are distributed, Anita Otobu, Head of Programme of the Nigeria Electrification Project (NEP) explains. In 2016, Nigeria has seen a Regulation for Mini-Grids. This is one of the first and most robust regulations on mini-grids, including IMGs, in Africa.

Where do African countries currently stand?

Encouraging examples of IMGs come from Nigeria. Launched in 2017, the Energizing economies initiative (EEI) increases power supply to economic clusters. One case is the Wuse market in Abuja. Currently in its pilot phase, an IMG is providing 30 shops of the Wuse market with electricity.

“As a tailor, I can testify that my income and productivity has significantly increased since my shop was connected to the mini grid system.”

Shop owner at Wuse market in Abuja/Nigeria

A second example from Nigeria is the Interconnected Mini-grid Acceleration Scheme (IMAS). IMAS was launched in 2019 by the Rural Electrification Agency (REA) with support of the EU and the GIZ. It aims at accelerating the deployment of IMGs by offering non-cash grants and technical assistance. As of April 2020, seven Nigerian companies have won the IMAS tender. At Makoloki Community in Ogun State, a first IMG has been installed in the framework of the IMAS.

For more information on IMGs in Nigeria, please refer to the recent SD Strategies report on Derisking Interconnected Solar Mini-Grid Investments in Nigeria. Other countries are following. In Kenya, Sierra Leone, Tanzania, Uganda, and Zambia, regulations already exist that support private sector mini-grid development.

Barriers to grid interconnection

There is still a way to go, though. Many African countries don’t have dedicated rules for private investments in mini-grids as well as on grid integration and grid owner compensation. And where these rules exist, they are often complicated and unclear. Most African governments also provide little information on grid expansion plans. The lack of information and regulations is a key barrier to interconnection in Africa, according to Joan Chahenza, Director for Energy Access Financial Advisory at the Africa Minigrid Developers Association (AMDA). In addition, Ms. Chahenza describes a lack of clarity of roles of institutions. Within the government, who is responsible for interconnection? The fact that this question often remains unanswered makes it even more difficult to organize interconnection.

A third barrier to grid interconnection is the lack of incentives either for the utility or the mini-grid owner to interconnect. Instead of joining forces, they often compete for donor money. Fourth, technical standards for large and mini-grids may differ. Finally, Ms. Chahenza explains that utilities oftentimes lack understanding of mini-grids and therefore remain skeptical of the interconnection.

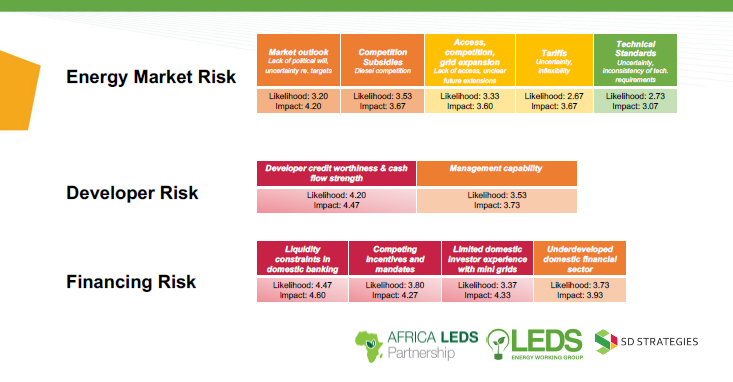

Readers interested in more in-depth analysis of the barriers to grid interconnection are invited to consult the SD Strategies’ report cited above. The report identifies a total of 23 barriers in 10 overarching risk groups and also investigates both their likelihood and their strength in case they occur. The overview below analyses three of these risk groups.

Incentivizing IMGs

Legal and licensing provisions are a first step towards an integrated energy system. They define the framework for partnership between utilities and sub-concession entities or operators. Will it be sub-concession agreements, franchise agreements or others? What roles will regulators or consumer groups have? In any case “there is a much stronger regulatory dimension to IMGs compared to off-grid mini-grids”, Divyam Nagpal says. And this means there is a need of legal provisions. Another key consideration, Joan Chahenza reminds, is harmonization of technical standards for inter-connection.

The second key element for successful grid integration is to create conditions for long-term and recurring investments. Regulators need to keep in mind that in one and the same concession area there shouldn’t be multiple tariff regimes, as Divyam Nagpal and Joan Chahenza agree. In any way, there needs to be a strong public financing design in place, and utilities will have a key role to play in structuring the transaction. Ms. Chahenza advocates for setting up a Grid Arrival Integration fund to cater for unforeseen costs incurred by developers at interconnection.

To increase bankability, subsidies are a must. Energy infrastructure can only work with sufficient subsidies, Mr. Ridolfi argues. In the same time, subsidies cannot be the single solution. In fact, tariffs in Africa are often so low, that there is little incentive for improving the power supply neither for the national utility nor for mini-grid developers, Mr. Ridolfi adds.

In the same time, policy makers should try to minimize the risks for private IMG developers. “It’s high time that we have conversations on net metering rules within policy frameworks”, Joan Chahenza highlights. In addition, compensation mechanisms can further reduce IMG developer risks. Such mechanisms can include repayment of debt, depreciation return of investments for shareholders and revenue compensation.

When the legal framework is there and governments have incentivized IMGs, as is the case in Nigeria and Uganda, IMG project development can begin. The planning process depends on political will as well as on sustainable partnerships between the utility and the mini-grid developer. “Increased stakeholder engagement is key”, Anita Otobu recalls.

Finally, Ms. Otobu argues that bureaucracy and bottlenecks might delay the permit approvals. Fast-track permit approval processes and mediated comprehensive negotiations amongst all the parties should start early to enable quick and cheap project implementation.

Complementing national grids with IMGs is a “match made in heaven”, as Riccardo Ridolfi puts it. Designed rightly, IMGs can add renewable electricity, technical stability, community presence, and local jobs to the energy system, while simultaneously fostering demand and reducing operating expenditures.

Further reading

With 137 attendees from 52 countries (including 27 African countries), the Africa LEDS Partnership’s webinar on IMGs was a great success! You are welcome to watch the recording below or have a look at the presentations as well as the Q&A minutes on the Africa LEDS Partnership’s website.

By viewing the video you agree that your data will be transferred to Youtube

More Information in our privacy policy

If you are interested in IMGs, please take part in this survey. You can find further information on IMGs in the recent SD Strategies report cited above and in the upcoming Policy guide to advance IMGs. Other useful studies were conducted by the Rocky Mountain Institute (2019), the MIT Energy Initiative (2020), and IRENA (2020). Readers interested in Mini-grids may also want to have a look at the Mini-Grid Technology Innovation Outlook (2016). Please also join the LEDS Global Partnership and the Africa LEDS Partnership and become a member of African Mini-Grids Community of Practice.

By Clemens Limp, LEDS Global Partnership Secretariat