GREEN BOND FRAMEWORK, LABELING, VERIFICATION, CERTIFICATION, & NATIONAL/REGIONAL STANDARDS

Note: How to define and categorize a green bond continues to evolve, and has significantly since the issuance of the first green bond in 2007. Given its relatively new entrance into the financial market, defining a green bond has transitioned from a simple framework that entities can use to help design their own green bond to a market that is moving towards more transparent and independent labeling of a green bond.

We note that some of the terms below may cause confusion due to interchangeable vernacular, so we seek to clarify how we are using each term by providing a definition and/or example criteria.

EVOLUTION OF THE GREEN BOND MARKET

- Self-Labeling

- Externally Reviewed:

- Second Party Opinion

- Verification Against the Green Bond Principles

- Certification under the Climate Bonds Standard

- Government/National/Regional Guidance

SELF-LABELING

Some issuers may simply label their bond as a green bond without seeking any outside validation of this claim. Such self-labelled green bonds are bonds that earmark proceeds for climate or environmental projects and have been labelled as ‘green’ by the issuer. At a minimum, the issuer needs to provide details to investors on the green eligibility criteria for the use-of-proceeds.

When a green bond is self-labeled investors must have a high degree of trust in the issuer and their credibility as there is no third party verification that the funds from the sale of the green bond were used for their intended purposes. As the green bond market continued to grow and investors sought higher levels of assurance many issuers sought a second opinion–or outside verification–prior to issuance.

EXTERNAL REVIEWS

Market Guidance

To enhance transparency, issuers can also bring in outside parties to conduct external reviews of the green eligibility criteria and use-of-proceeds. That verifier provides a review of the “greenness” of the project by verifying the claims made in the bond documents.

SECOND PARTY OPINION

Second party opinions are solicited prior to the issuance of the green bond and there is no follow-up or audit of the use-of-proceeds after the bond is issued. A Second Party Opinion assesses the project and reports on the environmental attributes. The Second Party might assign a rating indicating how climate friendly or environmentally friendly the project is.

There are multiple companies that provide second opinions; some examples include:

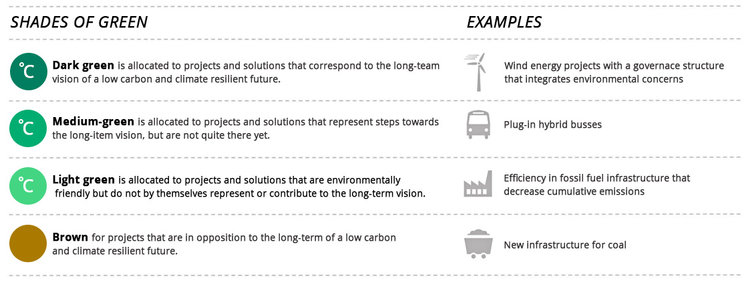

CICERO, a climate research organization based in Norway that evaluates projects and assigns “shades of green” to them depending on the environmental attributes and climate benefits.

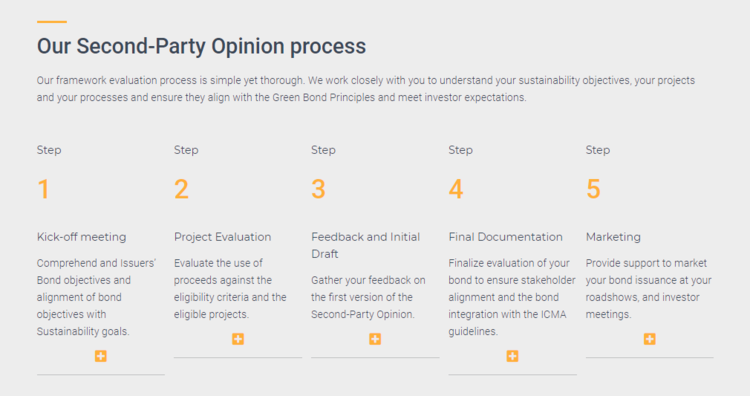

Sustainalytics, a global leader in ESG and Corporate Governance research and ratings, provides second party opinions in line with the International Capital Markets Association (ICMA) guidelines to help investors better understand green, social, and sustainable bonds through its “Second-Party Opinion process”.

Moody’s Green Bond Assessment, according to the website, offers a consistent, standardized and transparent framework for evaluating an issuer’s approach for managing, administering, and allocating proceeds to and reporting on environmental projects financed by green bonds across various security types globally.

S&P Global Green Evaluations is an asset-level environmental credential that aims to provide investors with a more comprehensive picture of the green aspects and climate risks associated with their respective portfolios.

VERIFICATION AGAINST THE GREEN BOND PRINCIPLES

The Green Bond Principles (GBP) were developed by market participants and the International Capital Markets Association (ICMA), a trade association for those involved in capital markets, and are updated regularly. The principles provide a framework to determine eligibility of projects and reporting requirements. According to ICMA, the purpose of the Green Bond Principles is not to develop a taxonomy or a standard but rather to provide an indicative list of the most commonly used types of projects supported or expected to be supported by the Green Bond market.

Auditors will assess a green bond’s alignment with the Green Bond Principles and the integrity of its green credentials.

CERTIFICATION UNDER THE CLIMATE BONDS STANDARD

The Climate Bonds Standards were developed by the Climate Bonds Initiative, a non-governmental organization dedicated to research and promotion of green bonds. They consist of a certification process, pre-issuance requirements, post-issuance requirements, and a suite of sector-specific eligibility and guidance documents.

Certification under the Climate Bonds Standard is a prescribed procedure using a published standard by list of approved verifiers and has checks after issuance to ensure compliance. In turn, this requires an extra layer of approval by CBI Climate Bonds Standard Board.

An advantage to Certification under the Climate Bonds Standards is that issuers and investors do not have to interpret a second party opinion.

GOVERNMENT / NATIONAL / REGIONAL GUIDANCE

An increasingly common standard for green bonds is that they must be issued and approved in accordance with the respective national and/or regional regulations within which they originate. Examples of countries that have specific green bond regulations include China, ASEAN, EU, Nigeria, Kenya, etc.

COUNTRY SPECIFIC

- China— In 2015, guidelines for what activities can be funded by a green bond have been issued by the People’s Bank of China and the National Development and Reform Commission. China Central Depository & Clearing Co. Ltd. (CCDC) along with the executive committee members of the China Green Finance Committee worked to develop the ChinaBond Green Bond Index; both parties also worked with China Energy Conservation and Environmental Protection group (CECEP) to build a green bond environmental impact disclosure benchmark system. Learn more here.

Read more about China’s green bond market below:

- How to issue a green bond in China: A Step-by-Step Guide

- China to cut coal from new green standards: sources

- Kenya — In February 2019, the Nairobi Securities Exchange released a legal framework for green Bonds that introduced a verifier component in order to verify the green assets and green financing. In order to be classified as a green bond, an independent verifier must conduct a pre-issuance review and confirm to the said parties that the green bond is aligned with the green guidelines and standards. These guidelines have been approved by the Capital Markets Authority, an independent public agency. Learn more here.

Read more about Kenya’s Green Bond Guidelines below:

- Download the Kenya Green Bond Guidelines

- Kenya paves way for green bonds in 2019 with new rules

- Kenya Green Bond Programme Kicks-off with Strong Backing from Banking Industry and Development Finance Community

EU TAXONOMY & STANDARDS

The European Commission set up a technical expert group on sustainable finance (TEG) to assist with the development of a unified classification system for sustainable economic activities, including a European Union (EU) green bond standard. Read more about the EU Taxonomy here. Further, the European Union is developing a standard drawing on the work of the Climate Bonds Initiative, ICMA, and others. If adopted, the standard could become another recognizable global standard for green bonds. The background document on the proposed standard is here.

ASEAN GREEN BOND STANDARDS

The ASEAN Capital Markets Forum (ACMF) issued the ASEAN Green Bond Standards to help countries implement their commitments under the Paris Agreement and the UNFCCC Sustainable Development Goals (SDGs). These guidelines also help standardize a set of rules for green bonds across the member countries, helping to both grow the market as well as increase transparency for issuers and cut down due diligence costs for investors.

OTHER EXTERNAL REVIEWER RESOURCES

THE GREEN BOND PRINCIPLES GUIDELINES FOR EXTERNAL REVIEWERS

To promote best practice in the provision of external review services for green, social, and sustainability bonds the Executive Committee of the GBPs worked with several verifiers to develop voluntary guidelines for external reviewers. Access the full document here.

IMPACT REPORTING

As stated by the Climate Bonds Initiative, impact reporting indicates any type of reporting (by a green bond issuer on the bonds’ use of proceeds) that looks to quantify the climate or environmental impact of a project or asset that is expressed numerically.

This level of reporting is gaining prominence in green bond markets, and helps investors measure positive externalities through their investments, and post-issuance reporting is critical to ensure the integrity of the green bonds market and therefore a requirement by most market guidelines (Climate Bonds Standard, Green Bond Principles or country-specific guidelines), however impact reporting is not key to differentiating between a green and a non-green asset.

Individual investor’s expectations differ according to circumstances, some of them do not demand impact reporting, whereas for others it is required.

The International Capital Markets Association recently published ‘Handbook – Harmonized Framework for Impact Reporting’, a framework that outlines core principles and recommendations for impact reporting in order to provide issuers with reference and guidance for the development of their own reporting and provided core indicators and reporting templates for Energy Efficiency and Renewable Energy Projects.

Additional Resources

STEP-BY-STEP GUIDES